When forecasts began showing an arctic blast aiming for Texas last week, an all-too-familiar anxiety rippled through the energy market. The...

Understanding the Risks of Virtual Power Purchase Agreements

Virtual power purchase agreements (vPPAs) are a common mechanism for large energy users to invest in clean power. These financial contracts allow companies to support renewable energy projects without directly owning or operating the physical assets (for a more detailed explanation, check out our vPPA explainer video). While vPPAs offer numerous benefits, they also come with inherent risks that need to be carefully considered.

At Verse, we specialize in empowering large energy users to make informed decisions about buying clean power. This blog explores key risks associated with vPPAs, providing you with the knowledge to understand the complexities and optimize your investments.

Market Price Risk: The Double-Edged Sword of Energy Prices

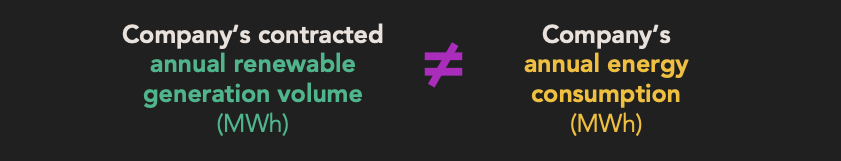

The first and most significant risk is Market Price Risk. This occurs when a company’s contracted annual renewable generation volume doesn’t align with the company’s annual energy consumption. The greater the mismatch, the greater a company’s exposure.

This risk can manifest in two primary ways:

- If market prices are higher than expected, and a company’s load over the year exceeds the generation it has purchased, the company may need to buy additional energy at high prices to meet its needs.

- Conversely, if market prices are lower than anticipated and the company’s load over the year is below the generation it has purchased, the company may find itself selling excess energy at market rates below the contracted energy price.

To mitigate this risk, it is important to conduct thorough market analysis and scenario planning. At Verse, we use advanced forecasting models to help our clients understand potential market exposure, price scenarios, and their implications on energy portfolio performance.

Shape Risk: When Generation and Consumption Don’t Align

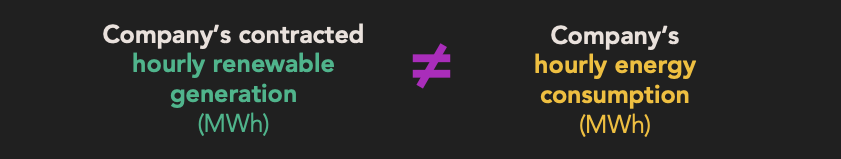

Next is Shape Risk. This risk arises when a company’s contracted hourly renewable generation volume doesn’t match the company’s hourly energy consumption.

Wind and solar power generation are highly dependent on weather conditions. For instance, solar power is only generated during daylight hours and can be affected by cloud cover. Wind power depends on wind speeds which can be highly variable. This leads to fluctuations in the amount of power generated over time.

The power output from wind and solar resources often doesn’t align with the demand profile of the energy consumer. For example, solar power production peaks during midday. But a company may need electricity in the evening, when solar generation is low or nonexistent and market prices are often high.

If the energy consumer’s short position coincides with high market prices, that can create more financial risk for its clean energy portfolio.

Managing Shape Risk requires a deep understanding of both your company’s energy consumption patterns and the generation profile of the renewable asset. Verse helps clients analyze these patterns and select vPPA structures that best align with their energy needs.

Basis Risk: Understanding Geographic Disparities

Basis Risk arises when the prices used to settle virtual power purchase agreements differ from the actual prices where the energy is consumed.

For instance, if a company based in Houston enters a vPPA for a wind farm in West Texas, the settlement price for the generation at the ERCOT West trading hub can vary significantly from the settlement price for the company’s consumption at the ERCOT Houston load zone. This discrepancy can lead to greater financial uncertainty than if the PPA were settled in the same region as the load.

To address Basis Risk, it’s essential to carefully consider the location of both your energy consumption and the renewable asset. Verse’s analytics platform helps clients evaluate different geographic scenarios and their potential impact on energy portfolio performance.

Volumetric Risk: When Mother Nature Has Other Plans

Volumetric Risk occurs when actual generation from a variable renewable resource does not equal the forecasted generation.

This is typically a result of variability in energy generation due to factors beyond human control, primarily weather conditions. Solar farms, for example, produce less energy on cloudy days, while wind farms generate less during periods of low wind. This variability can significantly affect the revenue generated from the vPPA.

Mitigating Volumetric Risk often involves diversifying your renewable energy portfolio across different technologies and geographic regions. Verse’s expertise in portfolio optimization helps clients build resilient clean energy strategies that can withstand the unpredictability of weather patterns.

Time Basis Risk: The Importance of Timing

Time Basis Risk occurs when the market used to settle a vPPA (for instance, the real-time market) differs from the market used to settle a company’s load (for instance, the day-ahead market).

This timing difference can erode the hedging effectiveness of the vPPA and introduce financial volatility for the energy portfolio.

For example, let’s assume that a company has a retail agreement that settles in the day-ahead market. Simultaneously, it has a vPPA with a solar project that settles in the real-time market. There’s a forecasted heat wave that results in high day-ahead prices, say $200/MWh, that are applied to the load. But the heat wave doesn’t materialize, and real-time prices at which the vPPA settles are much lower, say $50/MWh.

Even if the contracted vPPA volume perfectly matched the load consumed (in aggregate and by hour), this timing mismatch would have resulted in $150/MWh in extra costs.

Managing Time Basis Risk requires a nuanced understanding of both energy market dynamics and the relationship between day-ahead and real-time markets. Verse’s advanced analytics tools help clients model these temporal variations and select vPPA structures that balance forecasted costs and risk.

Empowering Informed Decision-Making around Virtual Power Purchase Agreements

While virtual power purchase agreements offer a powerful tool for large energy users to invest in clean power, they come with a complex set of risks that need to be carefully managed. By understanding market price risk, shape risk, basis risk, volumetric risk, and time basis risk, companies can make informed decisions about vPPA pricing and allocation of risk.

At Verse, we’re committed to helping our clients understand these complexities with confidence. Our sophisticated software and expert services provide the insights and analysis needed to make informed decisions about clean energy procurement. We help you model different scenarios, evaluate risks, and design vPPA strategies that align with your specific energy needs and sustainability goals.

As the clean energy landscape continues to evolve, staying informed and adaptable is key to success.

IMPORTANT NOTICE: This page is provided for general informational purposes only and does not constitute individualized advice or a recommendation tailored to your specific circumstances. Verse provides analytics software. The platform provides generalized models, scenarios, and reporting for educational and informational purposes. Verse is not acting and does not claim to act as an advisor to any counterparty, customer, or user of this website and expressly disclaims any fiduciary relationship or similar obligation to act on behalf of or in the best interest of any such counterparty, customer, or user of this website. In addition, Verse is not registered with the U.S. Commodity Futures Trading Commission as a commodity trading advisor in order to provide advice regarding the value or advisability of trading in swaps, futures, options, or other regulated derivatives products. Past or simulated performance is not necessarily indicative of future results. You should consult your own independent legal, accounting, and other professional advisors prior to engaging in any transactions or services described on this website.