I want to be able to report underperformance in real-time, as of today. Accrued data helps us have a better insight into our renewable energy percentage and explain swings early on.

Maria Koevska

Head of Product

As we look back on 2025, one thing stands out: almost every meaningful improvement we made to AriaTM started with a customer conversation. We heard from energy, finance, and sustainability teams navigating more volatility than ever, often with tools that weren’t built for the questions they were being asked. So this year, we focused on supporting customers in a few important ways.

Waiting weeks for PDF invoices or static reports to determine asset performance was a common frustration for teams. With Real-Time Telemetry Integrations, live generation data means teams have actual project performance within the day (not month), and a granular understanding of how this month will close for the accounting team.

I want to be able to report underperformance in real-time, as of today. Accrued data helps us have a better insight into our renewable energy percentage and explain swings early on.

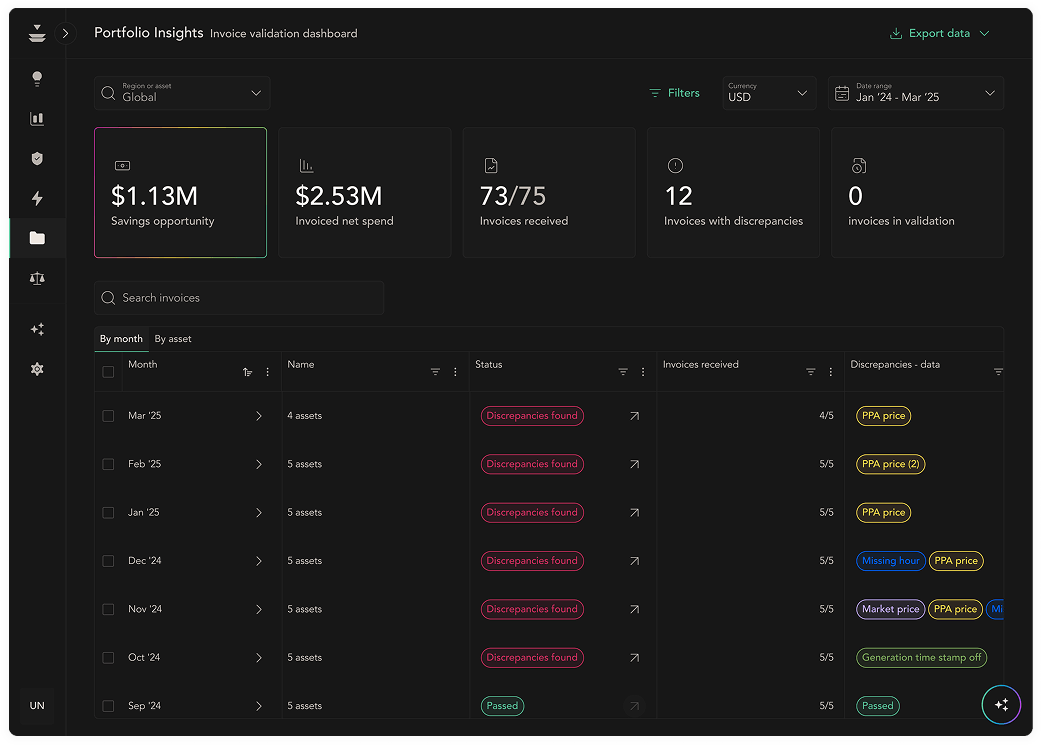

Invoice validation repeatedly came up as a major headache for asset managers. They shared how much time they were spending digging through line items, often reacting too late to catch issues. Working closely with those teams, we introduced Invoice Validation workflows that clearly show which invoices pass, which need attention, and why. The result is less manual work, faster issue resolution, and more confidence when engaging developers.

I am concerned with contract adherence and managing contracts, so having better data and a more streamlined process to do that is beneficial. As our portfolio grows, we need a platform that scales with us. We need streamlined workflows that get new projects into the system in days, not months.

Several customers told us the same thing: the time between PPA signing and COD felt like a black box. By the time the first invoice arrived, forecasts were already stale. That feedback directly shaped Pre-COD Digital Twins in Aria, which lets teams model how an asset will perform as if it were already live in the market.

The result is earlier visibility into pricing, performance, and exposure, eliminating the COD panic with proactive preparation.

We don't need another static NPV model. We needed a living, month-by-month view of how our PPA would actually perform — operationally and financially — before the project ever reaches COD. Until we have that, it is impossible to truly align finance, sustainability, and procurement around the same expectations.

We also heard from finance teams who were tired of explaining why forecasts didn’t match settlements. Generic assumptions around contract terms weren’t cutting it in a world of infinite PPA flavors.

In 2025, we strengthened our forecasting engine to support increasingly complex PPA portfolios, combining real contract logic with short-term market intelligence to deliver finance-ready cashflow forecasts.

The result is accruals that align with settlements, cleaner closes, and forecasts finance can stand behind as markets move.

Leadership doesn’t just ask how the asset performed last month. They want to know how the asset will perform over its life and if it’s still on track to meet the original approval case.

That’s why we expanded Lifetime Asset Performance Views, making it easy to move from monthly results to full contract-term outlooks without stitching together spreadsheets.

Our CFO wants to see the data carry forward as we're marching through the 15 year lifetime of our asset.

As customer portfolios expanded internationally, the need for consistent global views became critical.

This year, we added support for European markets, enabling teams to manage U.S. and European PPAs together with region-specific data and modeling, all in one platform.

Customers told us it was hard to explain why value changed, not just that it did.

We introduced Price–Generation Performance Visualization, showing market prices directly against generation output. By overlaying market prices directly against generation output, the correlation between price spikes and production is clear, demystifying changes in value and informing conversations with developers about settlement outcomes.

Our VP saw in the news that prices in ERCOT hit $4,000/MWh and sent me an email asking why weren’t making money on our PPA.

All of these improvements reflect one goal: helping energy teams spend less time explaining surprises and more time staying ahead of them.

See how Verse helps energy teams turn volatility into clarity across PPAs, assets, and markets — from pre-COD planning to day-one performance and beyond.

Get a demo